Remote payroll in Africa presents unique challenges for startups and established companies alike. When a Lagos-based startup hires developers in Nairobi and customer support reps in Accra, ensuring timely and compliant payroll across borders becomes a priority.

The accountant is buried in spreadsheets, trying to figure out Kenya’s NSSF rates, Nigeria’s pension contributions, and Ghana’s social security requirements. One payment gets delayed because of banking issues. Another employee asks why their take-home is different from what they expected. The founder realizes they missed a tax filing deadline in Kenya.

Managing remote payroll in Africa is more complex than most companies expect. Each country has different tax structures, labor laws, filing deadlines, and payment systems. What works in one market can get you fined in another. According to the Google-IFC e-Conomy Africa 2020 report, Africa’s digital economy is expected to reach $180 billion by 2025, representing 5.2% of the continent’s GDP

This guide walks you through everything you need to know about remote payroll in Africa. You’ll learn the compliance requirements for major markets, common problems companies face, and practical solutions that actually work.

Understanding Remote Payroll in Africa’s Unique Landscape

Remote payroll in Africa isn’t one market. It’s 54 countries with 54 different tax systems, labor laws, and regulatory bodies. What makes payroll in Lagos work won’t work in Nairobi or Accra without adjustments.

Each country sets its own minimum wage, pension contribution rates, and tax brackets. Nigeria requires National Housing Fund deductions. Kenya just replaced NHIF with SHIF in 2025. Ghana has different statutory deduction structures. You can’t use a one-size-fits-all approach.

Currency adds another layer of complexity. The Nigerian naira faced significant depreciation in recent years, affecting salary budgeting. Exchange rates fluctuate, impacting how much employees actually receive. If you’re paying in dollars or euros, timing matters.

Some countries have advanced digital tax systems. Others still require manual submissions to government offices. Kenya’s iTax system is relatively modern. Nigeria’s ITAS can be clunky. Ghana’s GRA portal has its own quirks. You need to understand each system’s requirements and deadlines.

Banking infrastructure varies, too. Mobile money works well in Kenya and Ghana. Nigeria has strong bank-to-bank transfers. But cross-border payments can take days and come with high fees. A payment that clears in two hours domestically might take a week internationally.

Investing in strong HR infrastructure, especially remote payroll systems, is a proven growth driver Deloitte research shows such organizations achieve revenue growth up to 2.5 times faster than competitors.

When Loubby AI became an implementation partner for Nigeria’s 3MTT program (Three Million Technical Talent initiative), managing payroll and onboarding for thousands of graduates across multiple states proved the importance of scalable systems. Without automation and proper compliance tracking, operations at that scale would collapse.

Payroll Compliance Nigeria: What You Need to Know

Getting compliance right matters. Miss a filing deadline or calculate deductions incorrectly, and you face penalties, audits, or worse. Here’s what you need to know for three major African markets.

Nigeria Payroll Compliance Requirements

Nigeria operates a Pay As You Earn (PAYE) system with progressive tax rates from 7% to 24% depending on income brackets. Employers must deduct this monthly and remit to the relevant State Internal Revenue Service.

Pension contributions are mandatory. Employees contribute 8% of their monthly salary, and employers add 10%. These go to the employee’s Pension Fund Administrator (PFA). You file with PENCOM and face penalties for late remittance

The National Housing Fund (NHF) requires a 2.5% deduction from employees’ monthly earnings above a specified threshold, typically aligned with the national minimum wage. These contributions are remitted to the Federal Mortgage Bank of Nigeria. Many employers miss this deduction as it is less discussed than pension or tax obligation

The Nigeria Health Insurance Scheme (NHIS) contributions generally apply to companies operating in the formal sector. Employers typically contribute 10%, and employees contribute 5% of the basic salary toward the scheme.

Filing deadlines are strict. PAYE remittance is due by the 10th of the following month. Pension contributions must reach the PFA within 7 working days after salary payment. According to compliance guidance from Accace and PenCom, missing these deadlines triggers automatic penalties that compound monthly.

Kenya Remote Payroll Compliance

Kenya’s PAYE system uses progressive tax bands from 10% to 35%. The Kenya Revenue Authority (KRA) manages tax collection through the iTax portal. Monthly returns are due by the 9th of the following month.

The National Social Security Fund (NSSF) contributions in Kenya changed in 2023. Both employer and employee now contribute up to 6% each of pensionable pay, capped at specific monthly limits. These contributions are remitted through the NSSF portal.

In 2025, Kenya replaced NHIF with the Social Health Insurance Fund (SHIF), introducing a 2.75% contribution rate on salaries. Employers are required to register employees and remit contributions via the SHA portal. Transitioning to SHIF proved challenging for many companies due to outdated payroll systems and implementation hurdles

Housing Levy of 1.5% applies to both employers and employees. This relatively new requirement catches many off guard. The Kenya Revenue Authority collects it alongside PAYE through iTax.

Ghana Payroll Compliance Standards

Ghana’s income tax uses progressive rates from 0% to 35%. The Ghana Revenue Authority (GRA) manages collection. Employers file monthly through the GRA portal by the 15th of the following month.

Social Security and National Insurance Trust (SSNIT) requires 13% of basic salary plus allowances up to certain caps. Employers contribute 13%, and employees contribute 5.5%. These contributions must reach SSNIT by the 14th of the following month.

Ghana’s minimum wage as of 2025 stands at GHS 18.15 per day. This applies to all workers and adjusts periodically. Paying below this rate violates labor law.

Workforce Africa’s compliance documentation notes that Ghana requires employers to maintain detailed payroll records for at least six years. During audits, the GRA can request these records without notice.

Multi-Country Payroll Challenges in Africa

Payment Delays Across Borders

Payment processing is often slowed by incompatible banking systems, causing delays of three to five business days between Nigerian and Ghanaian accounts.

Payroll Reporting Variations

Country-specific payroll reporting requirements like iTax in Kenya, ITAS in Nigeria, and the GRA portal in Ghana demand unique data and formats for each jurisdiction.

Currency Volatility Risks

Frequent currency fluctuations create budgeting difficulties, especially when salaries are budgeted in one currency but paid out in another.

Manual Compliance Requirements

Certain African countries still require physical payroll submissions, complicating processes and increasing administrative time spent on compliance.

Data Security Complexities

Payroll teams must manage different data protection rules (e.g., POPIA, NDPR, Kenya’s DPA) when handling personal data across several African nations.

Hidden International Transaction Fees

Cross-border payments are subject to correspondent banking costs, currency conversions, and transaction fees, significantly impacting budgets.

Daily Compliance Struggles

More than half of payroll teams face daily issues managing multi-country regulations, making compliance a critical but challenging part of payroll operations

How to Manage Remote Payroll in Africa Effectively

You can’t eliminate complexity, but you can manage remote payroll in Africa better. Here’s what actually works when running multi-country payroll for remote teams across the continent.

Choose the Right Payroll Infrastructure

Cloud-based payroll platforms beat spreadsheets every time. You need real-time access to payroll data from anywhere. Your accountant in Lagos should see the same numbers as your HR manager in Nairobi.

Centralized systems win over fragmented ones. Managing one platform that handles multiple countries is simpler than juggling separate software for each market. Integration with your existing HR tools matters too. If your time tracking, performance management, and payroll don’t talk to each other, you’re creating manual work.

When thinking about building scalable HR systems, payroll automation should be part of your foundation, not an afterthought. Companies that automate early avoid painful migrations later.

Payment Best Practices for Remote Payroll

Always pay employees in their local currency. Paying a Kenyan employee in dollars or naira creates conversion hassles they shouldn’t deal with. They have bills in Kenyan shillings. Give them shillings.

Use mobile money where appropriate. In Kenya and Ghana, mobile money is often faster and cheaper than bank transfers. M-Pesa in Kenya and MTN Mobile Money in Ghana are reliable. Not every employee has a bank account, but most have mobile money.

Batch payments to reduce fees. Instead of sending 20 individual transfers, group them into one batch. Most payment platforms charge less for bulk transactions. This also simplifies reconciliation on your end.

Set consistent pay schedules and stick to them. If you promise payment on the 25th of each month, deliver on the 25th. Late payments destroy trust faster than almost anything else. Your team plans their lives around when money hits their account.

Compliance Automation for Multi-Country Payroll

Manual tax calculations guarantee mistakes. Use software that updates tax rates and deduction formulas automatically. When Kenya changed NSSF rates in 2023 and introduced SHIF in 2025, companies with automated systems adjusted instantly. Those using spreadsheets scrambled.

Real-time legislative updates save you. African countries change labor laws and tax policies regularly. You can’t track every government announcement across multiple countries. Let your payroll system do it.

Statutory remittance tracking prevents missed deadlines. Your system should flag upcoming filing dates and confirm when payments reach tax authorities. The 10th arrives fast when you’re managing a business. Automated reminders keep you compliant.

According to insights from Research and Markets’ MEA Payroll Report, demand for multi-country payroll solutions in Africa is growing as more companies build distributed teams. The market recognizes that manual processes can’t scale.

Data Security for Remote Payroll Systems

Encryption standards matter. Your payroll data includes bank accounts, tax numbers, and salary information. This data needs end-to-end encryption both in transit and at rest.

Access controls prevent internal breaches. Not everyone in your company needs access to payroll data. Set role-based permissions so people only see what they need for their job.

GDPR and POPIA compliance isn’t optional if you’re handling personal data. Even if your company is based outside Africa, processing data for African employees triggers data protection requirements. Your systems need audit trails, consent management, and data retention policies.

Three Approaches to Multi-Country Payroll

You have options for how to manage multi-country payroll in Africa. Each approach has trade-offs.

In-house payroll teams give you complete control. You hire accountants who understand each country’s requirements. They manage everything directly. The upside is control and deep knowledge of your specific situation. The downside is cost and complexity. You need expertise for each country you operate in. Staff turnover means knowledge loss. This works if you have dozens of employees per country and can justify dedicated teams.

Outsourcing to local providers per country is common. You hire a payroll company in Nigeria, another in Kenya, and another in Ghana. Each handles its market. The benefit is local expertise without full-time staff. The problem is coordination. You’re managing multiple vendors with different systems and reporting formats. Getting consolidated reports across all countries requires manual work. Costs add up fast.

Unified multi-country payroll platforms handle everything through one system. You enter hours and any bonuses once. The platform calculates all statutory deductions for each country, processes payments, generates payslips, and files reports. This is usually the best option for companies hiring talent across Africa who need speed and accuracy without massive overhead.

Employer of Record (EOR) services work when you have just a few employees in a country and don’t want to set up a legal entity there. The EOR technically employs your people and handles all compliance. You pay them; they pay employees. This is expensive per person, but it makes sense for small teams testing a new market.

Streamlined Remote Payroll for Growing Teams

Running remote payroll in Africa shouldn’t take days every month. With the right platform, it becomes a background process that just works.

Loubby AI handles recruitment through payroll in one system. When you hire someone through the platform, their information flows directly into workforce management and payroll. No duplicate data entry. No missed fields.

Automated compliance across African markets means you don’t need to track changing tax rates manually. The system updates regulations for Nigeria, Kenya, Ghana, and other countries automatically. You calculate payroll, and the system applies current rates.

Mobile money and bank integrations give employees payment options. Some prefer mobile money for instant access. Others want bank transfers. The platform handles both without you managing multiple payment channels.

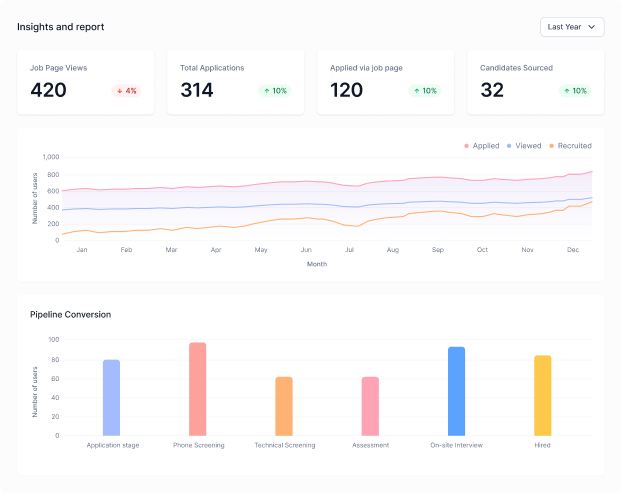

Real-time reporting and analytics show exactly where your money goes. You can see total compensation costs by country, department, or project. When budget planning time arrives, you have accurate data instead of estimates.

Time tracking and performance management integrate with payroll. Hours worked flow directly into salary calculations. Performance data connects to bonus calculations. Everything lives in one place.

Through partnerships with Nigeria’s 3MTT program and the National Youth Service Corps (NYSC), Loubby AI manages job placement and onboarding for more than 250,000 corps members annually. This scale proves the platform handles complex, multi-region workforce operations reliably.

The platform also partnered with Data Science Nigeria (DSN) for the DeepTech_Ready Upskilling Program, sponsored by Google.org. This partnership focuses on placing trained professionals into roles across Africa and globally, showing Loubby’s reach extends beyond borders.

According to Africa HR Solutions, companies that use integrated HR and payroll platforms experience faster payroll processing cycles and fewer compliance risks than those relying on a fragmented system

Common Remote Payroll Mistakes to Avoid

Even with good systems, companies make predictable mistakes with remote payroll in Africa.

Assuming one country’s rules apply everywhere is the biggest error. Just because pension contributions work a certain way in Nigeria doesn’t mean Kenya follows the same model. Always verify requirements per country.

Ignoring currency risk bites hard. If you promise a dollar amount but pay in local currency, exchange rate swings can create problems. Either pay in local currency with no conversion promises, or clearly explain how conversion works.

Skipping local tax registration before hiring is illegal in most countries. You can’t just start paying people and figure out taxes later. Register with tax authorities first, get your employer ID numbers, and then process payroll.

Not keeping detailed records costs you during audits. Most African countries require payroll records for at least five years. If you can’t produce documentation when tax authorities ask, you face penalties even if you paid correctly.

Waiting too long to automate creates technical debt. The longer you run payroll manually, the harder migration becomes. Start with proper systems early, even when you only have a few employees.

Missing statutory deadlines because you’re busy is never an excuse tax authorities accept. Set calendar reminders, use automated alerts, or better yet, use a platform that tracks deadlines for you.

Conclusion

Managing remote payroll in Africa is complex, but it’s not impossible. The challenges are real: different tax systems, varying labor laws, currency fluctuations, and banking inefficiencies. But companies successfully run remote payroll for distributed African teams every day.

The key is having the right infrastructure. Manual processes and spreadsheets stop working once you pass a handful of employees. You need automated systems that handle payroll compliance in Nigeria, Kenya, Ghana, and other markets, process payments reliably, and give you visibility into your costs.

Trying to become an expert in every country’s payroll regulations takes time you don’t have. Using platforms built specifically for African markets saves you from that learning curve. You get compliance baked in, payment routing figured out, and reporting handled automatically.

Start with a clear understanding of your requirements. Know which countries you’re hiring in and what those markets demand. Then pick systems that scale as you grow. Don’t wait until payroll day becomes a monthly crisis.

If you’re ready to simplify how you pay and manage remote teams across Africa, book a demo with Loubby AI to see how the platform handles everything from recruitment through multi-country payroll in one place. You can also explore pricing options to find a plan that fits your team size and needs.