Africa is fast becoming a leading source of remote talent. The continent’s tech workforce alone grew by more than 25% in just five years, with many professionals now working directly for companies abroad. This growth is nice to hear, but it has also brought a pressing issue to the surface: compliance.

Companies are eager to tap into African talent, yet many get stuck at the very step that determines trust and legality. Drafting proper contracts, staying in line with local labor laws, handling payroll across currencies, managing taxes, and correctly classifying workers often become stumbling blocks. Without clear processes, businesses risk fines, disputes, or even the loss of good workers.

That is why a structured approach is needed. A practical compliance checklist can help any employer reduce risk, move faster, and hire confidently across borders. By following simple but effective steps, businesses can create a foundation that protects both the company and the worker.

Draft Clear Contracts and Agreements

The first item on any compliance checklist is a written contract. Without it, both the company and the worker are exposed to unnecessary risks. A contract sets the tone of the working relationship and makes expectations clear on both sides.

Worker classification is one area that must be addressed early. Is the individual an employee with fixed hours and benefits, or a contractor who delivers based on agreed tasks? Getting this wrong can lead to penalties and disputes, so clarity is non-negotiable. The contract should also capture the scope of work in precise terms. What will be delivered, over what period, and under what conditions? This avoids confusion later.

Payment terms are another point that demands attention. Employers hiring across borders must clearly state how much will be paid, in what currency, and on what schedule. This not only builds trust but also protects against disagreements. Intellectual property rights should never be left vague. If the worker is creating content, software, or designs, ownership and usage rights must be properly defined in writing.

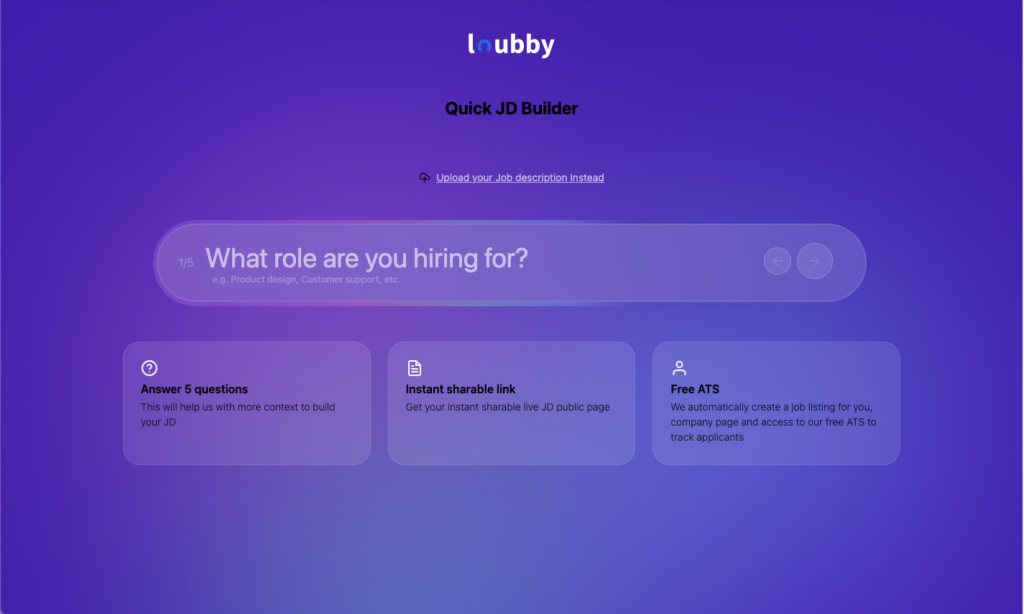

Creating these documents from scratch can take time. This is where HRTech platforms prove their worth. With the right structure in place, employers can focus more on building their teams and less on legal disputes.

Align With Local Labor Laws

Labor laws in Africa are far from uniform. What is acceptable in Nigeria may not hold in Kenya, and what applies in Ghana may be entirely different in South Africa. For instance, Nigeria has clear rules on employee pensions and tax deductions, while Kenya sets specific requirements for leave entitlements and statutory contributions. An employer hiring across borders must respect these differences or risk serious consequences.

Ignoring local regulations can expose a company to penalties, legal disputes, or even long-term reputational damage. Workers are quick to recognize when their rights are not respected, and word spreads fast. No business wants to be remembered as the company that cut corners with compliance. Protecting the company’s image is just as important as protecting the balance sheet.

The safest step is to treat compliance as an ongoing responsibility. A well-structured compliance checklist should always include local labor law research for each country where talent is hired. But keeping up with constant regulatory changes can be challenging for any HR team. This is where HRTech platforms provide real value. With features that track updates in labor laws and prompt employers to review their practices, companies can focus less on chasing regulations and more on building reliable teams.

Set Up Reliable Payroll and Tax Compliance

Paying remote workers across borders sounds simple until reality comes to play. Currency exchange rates fluctuate, payment timelines vary, and withholding taxes differ from one country to another. Without a clear structure, employers can end up with delays, underpayments, or penalties from tax authorities.

A payroll system that supports cross-border work is all about creating a transparent process that shows workers exactly what they are being paid, when, and how deductions are handled. This clarity builds trust and protects the company from disputes. At the same time, tax reporting cannot be left as an afterthought. Each country has its own requirements on how earnings should be declared and how much should be deducted. Overlooking these rules can quickly harm a company’s credibility.

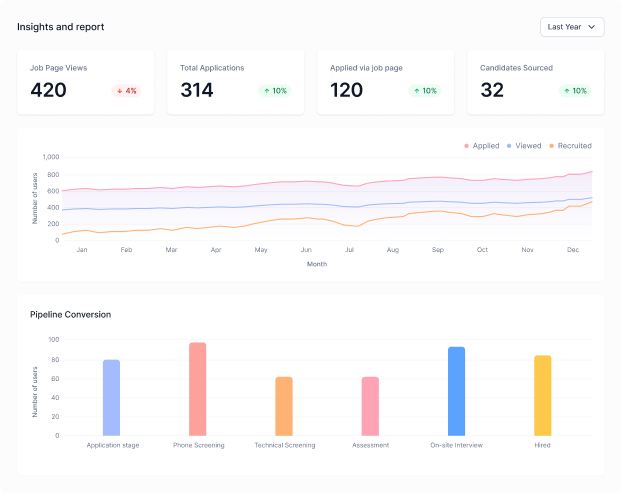

This is why payroll and tax compliance should always appear on a company’s compliance checklist. Instead of trying to manage multiple spreadsheets or depending on manual tracking, businesses can use HRTech solutions that automate payroll, apply the right tax rules, and generate reports that are ready for submission.

Loubby AI makes this process easier with integrated payroll and employee management features. It helps employers simplify what used to be a stressful process, leaving them free to focus on growing their teams.

Verify Worker Classification and Benefits

A common compliance mistake businesses make is misclassifying remote workers. Many companies call people contractors just to avoid paying certain benefits or taxes, but this can backfire. Governments are paying more attention to how foreign companies engage workers, and the penalties for getting it wrong can be heavy.

A good compliance checklist should always include proper worker classification. If someone is working fixed hours, reporting to a manager, or depending on your company for their main source of income, chances are they should be treated as an employee, not a contractor. This classification will determine what benefits and protections they are entitled to under local law.

Think about things like paid leave, health coverage, pension, and statutory contributions. For instance, some African countries require pension or social security contributions for employees, and failure to make those payments can attract fines or legal action. Even if you are hiring remotely, these obligations do not disappear.

The smart move is to review each hire carefully, confirm the legal definition of their role in that country, and make the right contributions. It may feel easier to cut corners in the short term, but building a fair and lawful arrangement gives your business long-term stability and keeps you out of trouble.

Secure Data and Privacy Compliance

Hiring remote workers means handling personal data across different countries, and that responsibility cannot be taken lightly. Every file you request, every CV you store, and every payroll record you keep has to be managed within the boundaries of local and international laws.

For example, the Nigeria Data Protection Act (NDPA). This law guides how organizations process and safeguard the information of Nigerian citizens. If your team works with clients or employees in Europe, then the GDPR comes into play. These regulations may look demanding, but ignoring them can put your company at risk of fines or legal trouble.

A smart way to stay on track is to work with a compliance checklist. This allows your HR team to review what data is collected, how it is stored, and who has access. Having a clear checklist prevents mistakes and reduces the chances of exposing sensitive details.

Technology can also play a big role here. HR platforms with built-in security features can automatically handle many of these requirements. They encrypt employee data, manage permissions, and keep detailed records for audits. Instead of worrying about missing one regulation or the other, you can focus on building trust with your employees and clients.

Build an Ongoing Compliance Monitoring System

Compliance does not end once you hire talent. Laws shift from time to time, and if you are not tracking them, small oversights can quickly grow into bigger problems. The smart move is to create a living compliance checklist that your team can rely on every day. This checklist should cover regulations across contracts, payments, taxes, and worker classification.

Conclusion

Compliance in African remote hiring rests on clear contracts, respecting local labor laws, accurate payroll, proper worker classification, data protection, and regular monitoring. Think of it as running through a compliance checklist that helps you stay on the safe side of regulations while protecting your business and your talent.

Instead of being slowed down by manual checks and endless paperwork, you can make the process easier with automation. Book a demo with Loubby AI today and see how compliance tasks can be simplified. With the right tools, cross-border hiring no longer has to be delayed or risky.