Overview

Sabi Microfinance Bank (Sabi MFB) is one of Nigeria’s fastest-growing financial institutions, dedicated to delivering accessible banking and lending solutions to underserved individuals and SMEs. As operations expanded across multiple states, the bank needed to rapidly scale its workforce to keep pace with rising customer demand, without compromising compliance, trust, or long-term sustainability.

Hiring the right talent was not just a growth necessity; it was mission-critical.

The Challenge

Like many fast-scaling financial institutions, Sabi MFB faced serious hurdles in its recruitment process. The HR team relied on a patchwork of job boards, referrals, and recruitment agencies, which led to several key challenges:

- High Cost of Hiring: Heavy spending on recruitment agencies and paid job ads significantly increased hiring costs, and there was still no guarantee of attracting the right talent. This limited their ability to scale efficiently and strained the recruitment budget over time.

- Unqualified Applicants: Despite posting roles on multiple platforms, Sabi MFB received a low volume of applications, and many of them still did not meet basic requirements. This made it difficult to build a strong candidate pipeline and slowed down the overall recruitment process.

- Slow Time-to-Hire: Manual shortlisting, interview scheduling, and communication made the hiring cycle unnecessarily long, often taking up to 2–3 months to fill a single role. This delay affected team productivity and slowed down expansion plans.

- Limited Visibility: Job postings were frequently buried among thousands of listings, reducing their reach and visibility to qualified candidates. As a result, many strong applicants were unaware of open roles, and the company struggled to attract high-quality talent.

- Tough Competition: Competing against larger, more established banks made it challenging to position Sabi MFB as an employer of choice. Many skilled professionals gravitated toward more recognized brands, leaving the HR team with fewer top-tier candidates to choose from.

How Loubby AI Streamlined Recruitment

1. The First Step: Posting Their First Role

Sabi MFB began their journey by posting a single role, Loan Officer, on Loubby AI. The impact was immediate, and several key features transformed their approach from day one:

- AI-Powered Job Matching: Loubby AI’s intelligent matching engine analyzed job descriptions against thousands of candidate profiles to automatically surface applicants with the closest match to Sabi MFB’s requirements. This meant the HR team no longer had to sift through irrelevant resumes, as most of the applicants already met core criteria. As a result, screening time was significantly reduced, and the quality of shortlisted candidates improved dramatically.

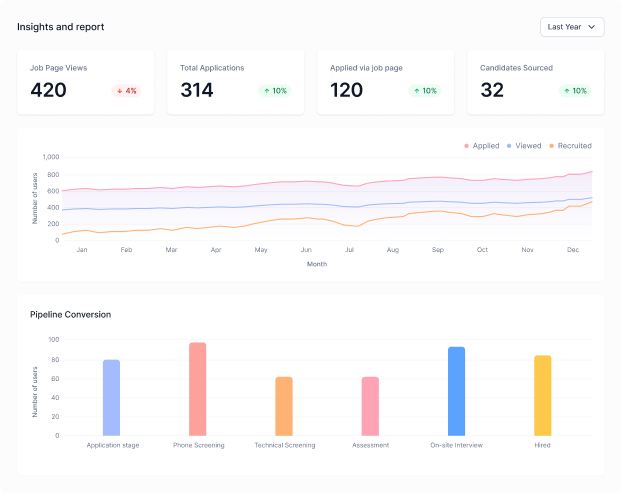

- Centralized ATS: Instead of juggling multiple spreadsheets, emails, and external tools, Sabi MFB’s recruitment team was able to manage the entire hiring process from a single platform. The built-in Applicant Tracking System (ATS) allowed them to track candidate status, filter by qualifications, and collaborate internally on evaluations. This not only saved administrative time but also brought structure and visibility to the hiring pipeline, making it easier to make faster, data-driven decisions.

- Candidate Engagement Tools: One of the major reasons for candidate drop-offs in the past was poor communication. Loubby AI solved this with automated updates, interview reminders, and status notifications that kept applicants informed at every stage of the process. This improved the overall candidate experience, boosted Sabi MFB’s employer reputation, and increased the likelihood that top candidates remained engaged until the offer stage.

- Branded Employer Profile: Establishing trust was essential for attracting top talent, especially as a growing microfinance institution competing with larger banks. Loubby AI’s free branded employer profile gave Sabi MFB a professional online presence that clearly communicated its mission, values, and career opportunities. This not only improved application quality but also helped the company stand out as a credible and desirable employer.

Within the first week, the HR team received a significantly more qualified pool of applicants. The improved relevance of candidates meant fewer hours spent on manual screening and a faster path to interviews and offers.

2. The Upgrade: Scaling Hiring Capacity

Encouraged by the success of their first posting, Sabi MFB quickly realized the need to scale recruitment across multiple departments as operations grew. Upgrading their plan on Loubby AI unlocked a new level of automation and efficiency that transformed their hiring capabilities:

- Featured Job Listings: Visibility was one of Sabi MFB’s biggest challenges before Loubby AI. By upgrading to featured listings, the company’s job posts were prioritized across the Loubby AI network, placing them in front of more relevant and qualified candidates. This boost in exposure directly led to a higher volume of applications from top-tier talent who might have otherwise overlooked the openings.

- Automated Shortlisting: Screening applicants manually was one of the most time-consuming parts of Sabi MFB’s hiring process. Loubby AI’s automated shortlisting tool changed that by ranking candidates based on predefined skills, experience, and qualifications. This reduced manual review time by more than 70 percent and ensured that the HR team focused only on the most promising candidates, speeding up decision-making and improving quality-of-hire.

- Auto-Application Workflows: Loubby AI also enabled continuous candidate sourcing by keeping roles active and automatically re-engaging with qualified talent even after the initial round of applications. This meant that the candidate pipeline never ran dry, and new applications continued to flow in without additional manual effort. As a result, Sabi MFB could maintain a steady supply of talent for critical roles at all times.

With these tools in place, the HR team was able to scale recruitment efforts rapidly and confidently. They filled multiple roles in parallel, improved candidate quality, and significantly reduced the time and resources needed to meet their growing workforce demands.

The Results

Within just 30 days of using Loubby AI, the transformation was undeniable:

- 75% faster time-to-hire, reducing hiring cycles from months to weeks.

- 5× more qualified candidates per role, thanks to AI-powered matching and visibility.

- 60% reduction in recruitment costs, by cutting reliance on agencies and expensive job boards.

- 95% increase in job visibility, ensuring every listing reached top-tier talent.

Conclusion

The Sabi MFB case demonstrates how financial institutions, especially those in microfinance, digital banking, and fintech, can transform their recruitment outcomes with an AI-powered hiring platform. Loubby AI proved that sourcing high-quality candidates does not have to be a slow, resource-intensive process; it can be streamlined, data-driven, and highly effective.

By leveraging Loubby AI, Sabi MFB moved from hiring challenges to recruitment momentum, building stronger teams faster, improving candidate quality, and scaling operations with confidence. For growth-focused financial institutions, the path to talent excellence and operational agility starts with smarter hiring, and Loubby AI makes that transformation possible.