Over 60% of African countries have changed their labour laws in the last six months, making hr compliance in Africa a serious concern for companies that want to hire talent from the continent. For businesses outside Africa, it is easy to assume that one set of rules fits all. But that is far from the truth. Each country has its own contract requirements, tax systems, employee classifications, and benefits regulations that can catch foreign employers off guard. Ignoring these details can lead to costly penalties, delayed hiring, and unhappy employees.

Many global companies face the challenge of managing these differences without clear guidance or the right tools. This article will help you spot common pitfalls and explain how to handle them smoothly. You will also learn how platforms like Loubby AI can simplify your hiring process and keep you on the right side of the law. By the end, you will understand what to watch out for and how to hire confidently across African borders.

Why HR Compliance Matters Across African Borders

When you talk about hr compliance in Africa, the risks tied to ignoring the rules are not just about fines or penalties. Companies that overlook local labour laws face legal battles that can drain resources and waste time. Beyond money, these mistakes can damage a company’s reputation, making it harder to attract good talent or even keep the employees they already have.

With the way a lot of African countries have updated their labour laws, there is a good chance that the laws you knew about have changed. For businesses in the US or Europe looking to hire in Africa, this creates a big challenge. If they fail to keep up, hiring processes slow down, contracts become risky, and employee trust drops.

Many companies lose time and money trying to fix problems that could have been avoided. Hiring pauses, unclear contracts, and unexpected payroll taxes make operations complicated. Because of this, some firms even give up on African talent altogether. This is a missed opportunity because Africa offers a growing pool of skilled workers. The truth is, respecting hr compliance in Africa helps companies build strong teams and avoid costly mistakes. Taking time to understand and follow these laws is not an extra task; it is part of doing business the right way.

Employment Law Differences: Nigeria, Kenya, South Africa (and beyond)

Hiring across borders might sound like child’s play, but when you look closely at how different African countries treat employment laws, it becomes clear why hr compliance in Africa needs more attention than most companies give it.

Let’s start with Nigeria. In Nigeria, every employee must have a written contract within three months of starting work. That contract must spell out things like job role, salary, work hours, and termination terms. Payroll is not straightforward either. Employers are expected to handle multiple deductions, including personal income tax (PAYE), pension, and health insurance. And if you’re hiring contractors, you need to be careful not to mislabel full-time employees to avoid paying tax.

In 2024, Kenya updated its payroll structure, adding new rules for housing levy contributions. This means every employer now pays 1.5 % of an employee’s gross salary into a housing fund, matched by the employee. On top of that, there are mandatory contributions like NSSF and NHIF. Benefits like paid leave, sick leave, and maternity leave are protected by law and must be tracked properly.

In South Africa, employers must follow the Basic Conditions of Employment Act (BCEA) and contribute to the Unemployment Insurance Fund (UIF). Terminating a worker is not a simple case of giving notice. The process requires valid reasons and sometimes formal hearings. Discrimination and equity are big issues too, governed by the Employment Equity Act.

If you’re considering countries like Ghana or Ethiopia, or Rwanda, the rules are different again. Ghana expects written contracts and enrolment into SSNIT (the national pension scheme). Ethiopia enforces a minimum wage and mandatory rest periods that employers often overlook.

What works in one country can cause problems in another. That’s why you shouldn’t treat hr compliance in Africa like a one-size-fits-all thing. Every country plays by its own rulebook, and knowing those rules can save you from hiring problems down the line.

Common Compliance Mistakes by Global Employers

One of the biggest problems is misclassifying contractors as employees or vice versa. This mistake happens a lot because hr compliance in Africa is not always straightforward. Treating a full-time employee as a contractor might save costs at first, but it can lead to penalties if the law says otherwise. Contractors often do not get the same benefits or protections as employees, so getting this wrong means you could owe back payments, taxes, or fines.

Another trap is using contract templates from outside Africa without changing them for local laws. These foreign contracts often miss key requirements like specific clauses on leave, termination, or dispute resolution. Because each country has unique rules, a copied contract may fail legal tests and leave the company exposed.

Many employers also forget to include mandatory benefits like pensions, health insurance, or unemployment funds. For example, South Africa’s UIF and Nigeria’s pension schemes require contributions from employers. Leaving these out creates compliance gaps that attract penalties and hurt employee morale.

Finally, some companies ignore the proper notice periods and procedures needed for terminating employees. African labour laws often require formal warnings, written notices, or even hearings before ending a contract. Skipping these steps can result in costly lawsuits or reinstatement orders.

How to Ensure Compliance: A Practical Framework

When it comes to hr compliance in Africa, taking the right steps early helps you avoid costly mistakes and keeps your business running smoothly. Here are some practical ways to stay on the right side of the law:

1. Start with Local Law Research

Before hiring in any African country, take time to study its labour laws. Each country has its own rules around contracts, benefits, taxes, and terminations. What works in Kenya might land you in trouble in Ethiopia. Don’t rely on guesswork. Go straight to the official labour codes or hire a local legal expert to break things down for you.

2. Build Country-Specific Contract Templates

Using one contract for all countries is risky. Instead, create contracts that reflect the legal requirements of each country you hire from. This means including local leave policies, termination rules, and benefit clauses. Contracts built for each market protect both you and your employees.

3. Use HR Tech or Employer of Record (EOR) Services

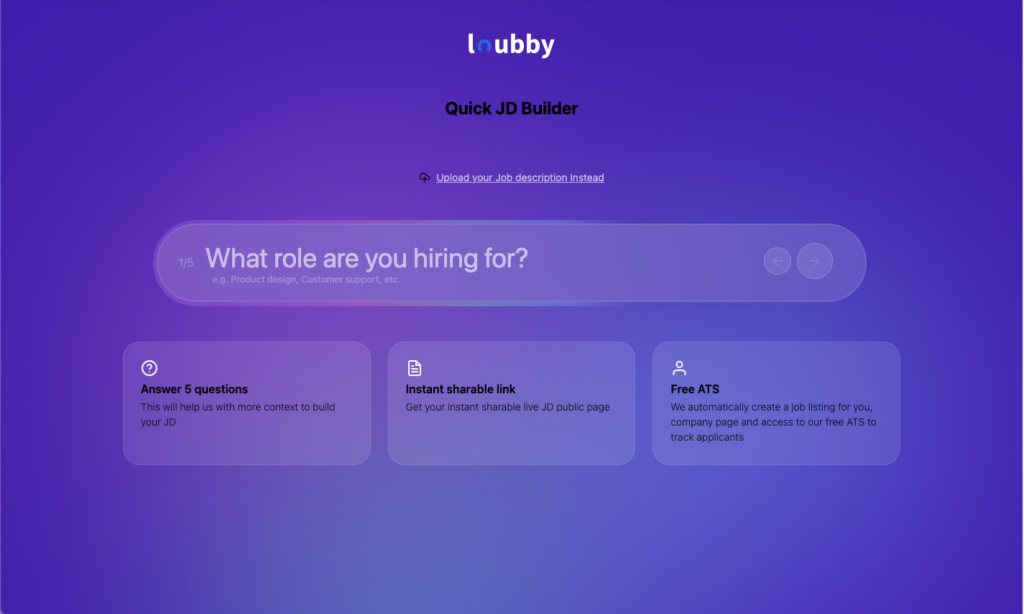

Software like Loubby AI or EOR partners can help you manage compliance without lifting too much weight. They take care of country-specific rules, automate contributions, and handle payroll tax filings for you. This way, you reduce errors and move faster. You can also stay updated on legal changes without spending hours reading policy updates. Platforms like Loubby AI are built to keep you in check as rules shift.

4. Conduct Regular Payroll and Contract Audits

Mid-year reviews of your payroll and employee contracts help catch mistakes early. Payroll errors or missing contract clauses can lead to fines if left unchecked. Regular audits keep your hiring compliant and your employees satisfied.

Following this framework makes hr compliance in Africa manageable. It reduces risks and lets you focus on building your team rather than fixing problems.

How Loubby AI Simplifies Cross-Border HR Compliance

- Country-Specific Contract Generation

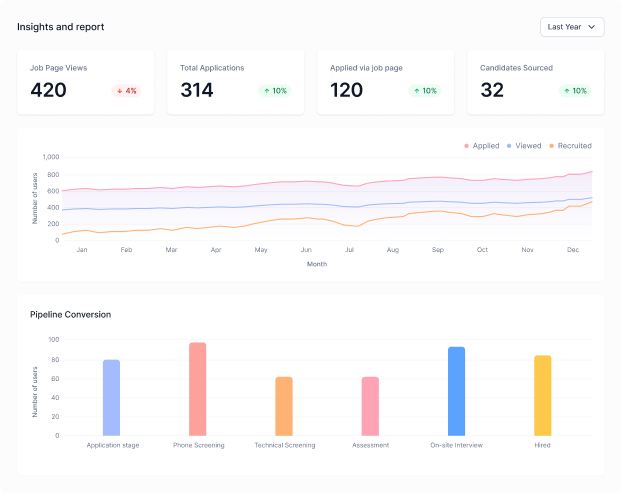

Loubby AI creates contracts that are tailored to each country’s labour laws. Whether you are hiring in Nigeria, Kenya, or Ghana, the platform makes sure your agreements reflect the right clauses, notice periods, benefits, and legal terms. - Payroll Compliance Engine with Legal Updates

African labour laws change often, and missing one update can create serious problems. Loubby tracks those changes in real time and adjusts payroll settings automatically. So if a new tax rule kicks in, your business stays compliant without delay. - Full Payroll Automation

The system connects with time tracking and expense records, then calculates salaries, deductions, and taxes across countries. It supports direct bank deposits and handles multi-currency payments. Employees get paid correctly and on time, and you don’t have to worry about errors or late payments. - Tax Compliance and Deduction Management

Loubby makes it easy to stay within tax rules by managing withholding taxes and local deductions based on the country of each worker. Everything is recorded and easy to audit.

Conclusion

African employment laws vary widely from country to country, and hr compliance in Africa is not something companies can ignore. Failing to meet local regulations puts your business at risk of fines, legal problems, and a poor reputation. Getting compliance right is a must if you want to build strong teams and avoid costly delays.

To stay safe, use a combination of tools, expert advice, and reliable technology. Working with local counsel helps you understand specific laws. Creating country-specific contracts ensures your agreements match local rules. Regular audits keep your payroll and contracts clean. And most importantly, using a platform like Loubby AI makes managing these tasks easier by automating updates and handling payments correctly.

If you want to see how hiring across Africa can be fast and straightforward while keeping everything legal, book a Loubby AI demo today.