Hiring remote talent from Africa has quickly become a popular strategy for many companies looking to expand their teams efficiently and cost-effectively. With skilled professionals across Nigeria, Kenya, Ghana, and other African countries, businesses have access to a huge pool of contractors and employees ready to deliver results. It also brings its challenges, particularly when it comes to ensuring that these employees are paid accurately and on time. Payment delays, unclear deductions, and messy paperwork often cause issues for both employers and workers. On top of that, keeping up with different countries’ rules around taxes and compliance comes with another type of problem.

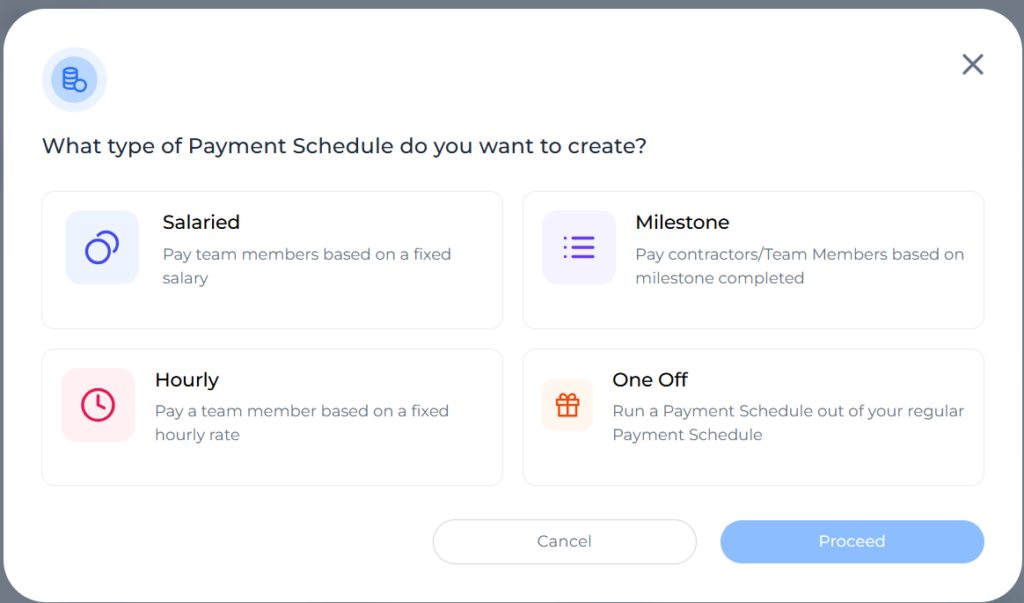

Many HR managers and founders find themselves stuck using payroll systems that do not fit the unique needs of African contractors. These tools may work fine for traditional full-time employees in one country but fall short when handling salaried, hourly, milestone, or one-off payments across borders.

This is why finding the best payroll system for African employees is important. The right system should handle various payment types, stay on top of compliance, and make payroll management simple and transparent. In this article, you will learn what to look for in a payroll solution that fits African teams. You will also discover how Loubby AI offers features built specifically to meet these needs, helping employers pay their contractors and employees quickly and accurately

Why Traditional Payroll Systems Don’t Work for African Teams

Many traditional payroll systems struggle to meet the needs of African teams. One big problem is that they often lack support for local banks and currencies. When you want to pay contractors or employees in Nigeria, Kenya, or Ghana, these systems may force you to use foreign accounts or complicated currency conversions. This makes payments slower and more expensive.

Also, these systems rarely help with local compliance rules. Every country in Africa has its laws on taxes and mandatory contributions. Without built-in compliance tracking, employers risk fines or penalties because they miss these rules or don’t calculate deductions properly.

On top of that, payment options are often limited. You may want to pay a contractor monthly, another weekly, or release funds only after a project milestone is met. Traditional systems rarely allow this kind of flexibility.

Finally, these platforms usually come with high fees and long wait times for payments to clear. Sometimes, payments get delayed or lost, which can be very frustrating for both employers and contractors.

Because of these gaps, businesses looking for the best payroll system for African contractors face many roadblocks when using old-school payroll software. A system built with African markets in mind solves these issues and simplifies payroll for everyone.

What Makes a Payroll System Ideal for African Contractors or Employees

Here is what the best payroll system for African contractors and employees should include:

Multiple Contract Types

A proper payroll tool must allow you to manage different working styles in one place. Whether it’s full-time staff on a fixed salary, freelancers paid per milestone, or workers logging hours, the platform should support them all. That way, you won’t need to create workarounds or use several tools for one team.

Flexible Payment Schedules

Not everyone wants to be paid monthly. Some want weekly payments, some prefer bi-weekly or semi-monthly. A good payroll system should give you options so you can match your contractors’ needs. When your team is paid on time and as agreed, it builds trust and keeps people motivated.

Allowances and Deductions

In Africa, it’s common for employers to add transport allowance, housing allowance, or bonuses. Deductions like pensions or taxes may apply too. A smart payroll system should let you add these with ease and adjust them as needed, without causing confusion or manual errors.

Local Compliance Support

Every country has different rules. If your payroll tool doesn’t help you track any African complaince rules, you’re putting your business at risk. A system that helps you follow local laws, generate audit-friendly reports, and keep clear records will save you time and protect your company from issues.

Wallet Funding and Instant Payout

The best payroll system for African contractors should not make you wait for days to move money. It should allow you to fund your account instantly and pay out when you’re ready. There shouldn’t be a back-and-forth with banks. Just simple, fast transactions that your team can count on.

African Bank and Wallet Support

If your contractor has to set up a foreign account or wait a week to access their pay, something is wrong. Payroll should connect easily with African bank accounts or digital wallets. That way, your team gets paid in their local currency, straight to the account they use every day.

Transparent Payment Records

Everyone wants to see what was paid, when it was paid, and what deductions were made. Your payroll system should keep a clean log of all transactions. That clarity matters during audits, tax filings, or if there’s ever a payment dispute.

How Loubby AI Solves These Payroll Challenges

Loubby AI brings together everything you need to pay African contractors and employees in one place. The platform understands that paying teams across Africa isn’t a one-size-fits-all situation, so it offers features that match good working conditions.

1. Run Payroll Directly From Your Dashboard

Everything starts from the employer dashboard. Once you’re logged in, you can run payroll without chasing spreadsheets or toggling between different tools. You can pay full-time employees, contractors, or anyone else you’re working with all from one place.

There are four payment types available:

- Full-Time Payroll: This is for team members on a fixed salary. You can schedule payments to go out weekly, bi-weekly, semi-monthly, or monthly, depending on your agreement with the employee.

- Milestone-Based Payroll: If you’re working with freelancers or project-based contractors, you can set specific milestones, attach payment amounts to each one, and even choose to enforce a sequence. This means no one can start the next milestone until the current one is approved and paid. It brings structure to work that often feels scattered.

- Hourly Payroll: For contractors who work based on time spent, there’s a timesheet feature. Employees or freelancers fill out their hours and submit them, so you’re not guessing how long they worked. You have full visibility into hours logged before payment goes out.

- One-Off Payments: Sometimes, someone helps you with a task just once, and you need to pay them quickly. The one-off option allows you to do just that without adding them into a full payroll cycle.

Adding Allowances and Deductions

Adding allowances like housing or transport, as well as deductions such as pension or taxes, is straightforward. The system handles these automatically, so you do not have to calculate them separately or worry about missing anything.

2. Employer Wallet for Seamless Payouts

Loubby AI gives employers full control over their payroll funds through a secure wallet system. You can fund your wallet at any time and pay your contractors or employees directly from it without waiting on banks or third-party services. Having your payouts all managed in one place means you can see exactly how much is available, what has been spent, and plan for upcoming payments. This level of control helps businesses avoid last-minute surprises and ensures your team gets paid on time.

3. Flexible Scheduling and Milestone Enforcement

Loubby AI allows you to set payroll schedules that fit your team’s rhythm. Whether you want to pay weekly, bi-weekly, semi-monthly, or monthly, the system adapts to your needs.

4. Designed for African Talent

Loubby AI understands the realities of working in Africa. The platform supports local bank accounts and currencies, which means your contractors receive payments in the way they are used to without hassle. There is no need for complicated workarounds or extra accounts.

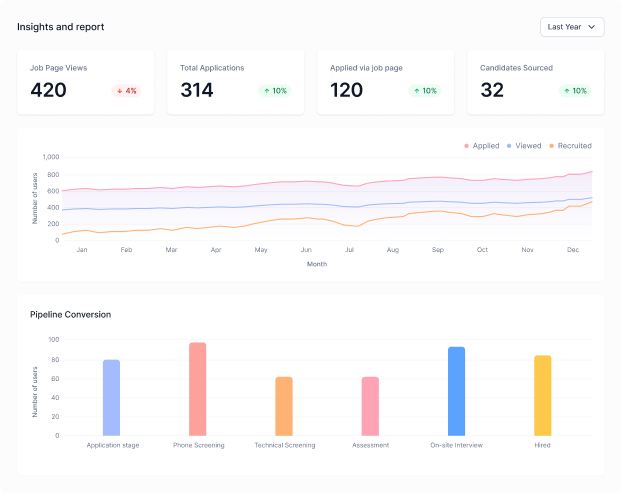

In addition, Loubby AI provides clear and transparent reports that show every payment made, deductions applied, and funds available. These logs simplify audits and make reconciliations straightforward. Businesses can stay compliant and maintain clear records without extra effort.

Why Global Teams Choose Loubby AI to Pay African Talent

Founders and HR leaders who work with African teams face many challenges, but Loubby AI helps ease those burdens. By using this platform, businesses cut down on overhead costs tied to payroll management. Payments happen faster, removing delays that can hurt trust with contractors and employees. At the same time, Loubby AI keeps things compliant with local tax rules and financial regulations, giving leaders peace of mind.

Loubby AI scales smoothly, whether you are hiring your first contractor or managing a team of 100 across several African countries. The platform grows with your business, making it simple to onboard new hires and manage payroll without extra headaches.

Conclusion

Paying African contractors and employees should not be a source of stress or delay. The process does not have to be stressful or slow. With Loubby AI, you gain control over your payroll, speed in making payments, and clear records that keep everything transparent. At the same time, you stay compliant with local rules, so your business avoids unnecessary risks.

When your payroll system works smoothly, you can focus more on growing your team and your company without constant worries about who gets paid and when. Loubby AI brings together everything you need to manage payroll for African contractors in one simple, reliable platform.

If you want to stop the hassle and start paying your African talent the right way? Book a free demo and get started with Loubby AI Payroll today.